“Innovate with purpose to create meaningful technology products and experiences”, WGSN.

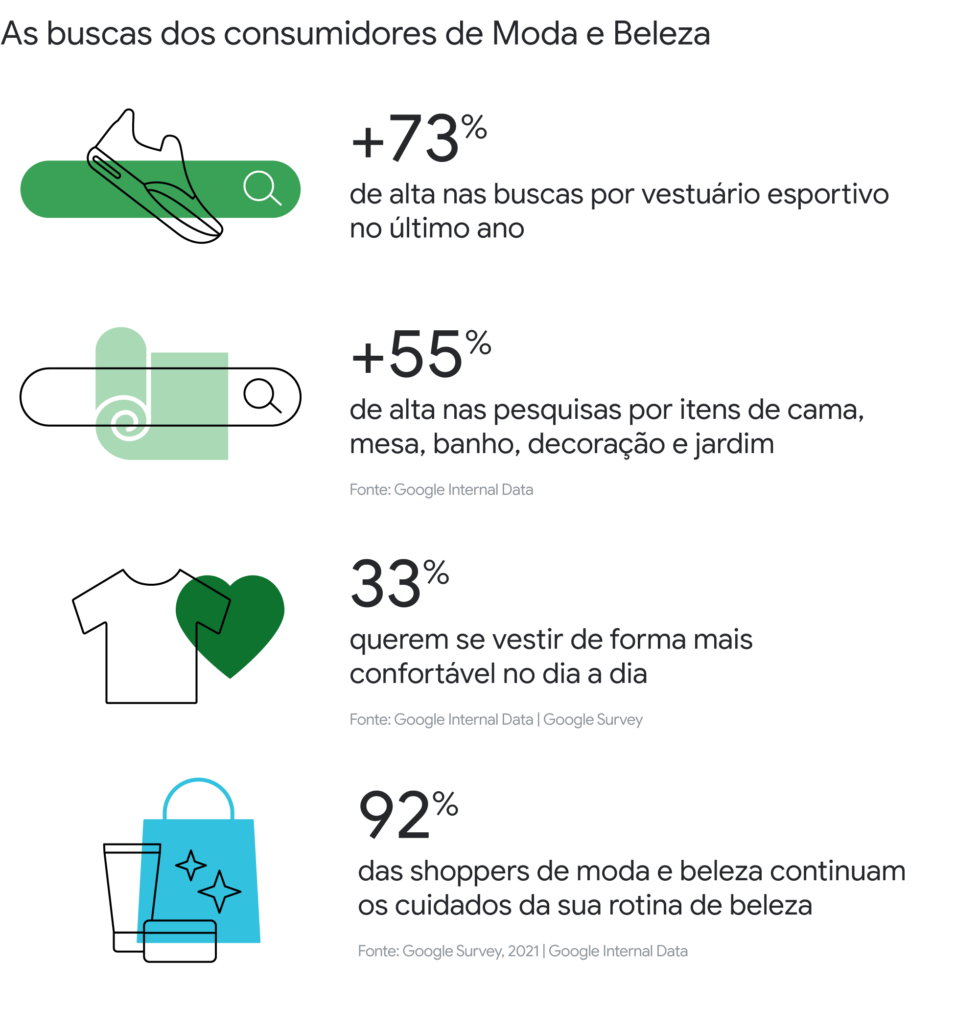

New trends of behavior and consumption in the fashion universe.

During the pandemic, new consumer behavior promoted business opportunities for fashion companies, propelled the emergence of consumer trends.

Data and Insight

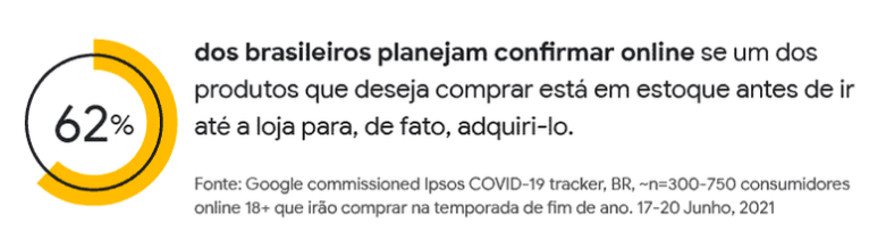

Technology is becoming increasingly important when it comes to consumer relationships. The advances in technology accelerated during the pandemic and research made by Think with Google revealed some insights: 88% of online shoppers research online before making a purchase; 3 out of 4 consumers in Brazil buy fashion and beauty products on online platforms.

“Technological innovations are powerful allies to attract customers. Digital makeup and augmented reality for fashion, for instance, are recent trends.”

Consumer Technology

“Innovate for the purpose of creating products and significative technological experiences,” WGSN.

Predicting new consumer technology tendencies enables the creation of products that will improve the lives of future consumers, foreseeing new lifestyles and guiding the design of new products.

Setting a price for fashion with science

Applying statistical approaches to pricing methods in fashion can lead to substantial improvements in product sales and margins.

Pricing is one of the most challenging areas for fashion apparel retailers due to the high SKU (Stock Keeping Unit) complexity, limited item comparability, and frequent flow of new collections.

Merchants prefer to rely on the intuitive sense of the price consumers would be willing to pay, competitive benchmarking, and margin contribution. Even though this is the age of big data and online pricing transparency, this reliance on subjective pricing still prevails in the marketplace.

Heuristic Model

“We recommend a model that allows merchants to enhance their business judgment and gut intuition with science”, McKinsey & Company.

The “heuristic” model uses internal and external metrics that incorporate relevant factors. The initiative applies statistical analysis to filter these factors and tailor metrics to each retailer’s business strategy.

Pricing factors: Domestic economics influence the retailer’s product margin target; competitive dynamics can drive the price to a higher level; on the other hand, brand value can push prices down.

The model presents two problematic indicators in apparel pricing: elasticity, relatively common in consumer sectors that rely on stable data points.

“Gauging the appropriate level of elasticity is critical, because this assessment is then used to guide overall price adjustments, to project new unit volume, and to quantify net revenue and profit impact”, McKinsey & Company.

Another innovative indicator: the perceived value of individual product attributes.

“By breaking down all possible attributes and understanding their perceived value, the pricing can be tailored appropriately. Although each of the indicators could be used individually to set a price for a style, we believe retailers should use a combination of relevant indicators, assigning a weight to each one, in order to arrive at a price recommendation. Depending on the retailer’s objectives, that recommendation could maximize product profitability or market share”, McKinsey & Company.

Stronger analytical capabilities and rethinking how to collect and structure the data relevant to each indicator are essential tools for implementing this approach. And understanding the retailer’s business and strategic pricing objectives determine the weight of each process indicator.

“Although this approach relies on the ‘science’ of external analytical tools, it remains rooted in the ‘art’ of merchant expertise and knowledge. Because it is based on strategic decisions for weighting indicators, it is a flexible model that can easily be updated to keep pace with changing business strategies. As long as fashions change with the seasons, there will always be an element of unpredictability in apparel pricing. Retailers have much to gain by harnessing the wealth of knowledge they have at their disposal and applying these innovations to their apparel pricing strategies”, McKinsey & Company.

Learn more about pricing and competitiveness…

What makes your product unique?

Focus on quality and transparency

Associates Flávia Aranha and Movin are certified by Sistema B Brasil, which is the purpose of the brand’s impact and is at the heart of its business model; profits and growth provide a force for good: triple positive impact for your employees communities and the environment.

“A more inclusive, equitable, and regenerative economic system,” Sistema B Brasil.

“We are the first Brazilian fashion company to receive the B company certificate, the B Corp Certification, which recognizes and validates new organizational models that encourage the use of strong businesses to solve social and environmental problems, always in line with the concept of solidarity economy,” Movin.

Selo B companies balance purpose and profit in the following areas: Governance, Workers, Customers, Community and Environment.

“We have been certified by Sistema B since 2016. It is an initiative that is active in more than 50 countries, consolidating transparency in production processes and addressing socio-environmental impacts, equating them with profit in the priorities of a company’s management,” Flávia Aranha.

Raw material and workforce

“More than three in five consumers say that environmental impact is an important factor in purchasing decisions,” McKinsey.

Conscious consumption and a more conscious future express the consumer’s social responsibility. Expanding circular business models, strategies to reduce waste and more efficient use of resources, promote positive environmental impact in the fashion industry. “The less impact on the planet, the more benefits there will be for businesses, people and the environment.” Read more about the importance of supplies in the circular economy…

Associates Vert and Osklen found an adequate reuse for their inputs. The initiative reassesses the work processes and the entire productive chain to evaluate current transformations and consumption demands.

“We do not believe in a romantic view of ecology. Our path is economic recovery. At VERT, this involves social work: rubber tappers and cotton producers receive a differentiated value for preserving forests and rural lands,” Vert.

“Pirarucu is one of the largest freshwater fish on the planet. Native to the Amazon, it is an important part of its ecosystem, in addition to being a source of income for riverside communities that live off non-predatory fishing. Our productive process protects the species, balances the region’s food source and economy, and contributes to the preservation of the Amazon rainforest,” Osklen.

Training

The brand from Ceará, Catarina Mina, expresses transparency, awareness and collaboration.

“Transparent fashion, focused on the people who are responsible for the production process; the idea of a different kind of fashion has always enticed us – a fashion that inquires more than answers.”

The associate presents the Olê Reindeiras project in partnership with Catarina Mina and QAIR Brasil, to train and honor its collaborators, the lace artisans of Ceará.

“We believe in a different kind of fashion, fashion that is focused on the people who are responsible for the production process, and focuses its efforts on questioning, reassessing, reflecting and making decisions considering the collective. A fashion that sustains itself in a collaborative future. “

Design and Meaning

Silvia Furmanovich, jewelery and marquetry.

The creative alchimist Silvia Furmanovich portrays cultural richness and diversity creations with crafts, nature, ancient traditions, and unusual material.

“I have always collaborated with artists and artisans to new things. In this technological world, everything is being made by machines and we must all fight to keep traditional handicrafts alive,” Silvia Furmanovich.

The associate’s timeless art and design features unique alchemy, mined objects, traditional, natural and precious materials and techniques.

Sy&Vie, colorful and a with a touch of Brazilian soul.

“For us, each bag is like a sculpture. We cut, sculpt, and model each one by hand. We carefully think about each detail. We idealize each design, each sensation, and we create small works of art that contain powerful stories.”

The brand’s creative process transcends details and incorporates traditional marquetry, carving and assemblage techniques.

“My goal has always been to bring together my two greatest inspirations: nature and ancient artisanal methods of production,” Sylvie Quartara.

The artist looks for new materials and expresses sustainability in the use of certified wood, certified and sustainable leather, traceability in the production process, and the sustainable 3D printing technique on recyclable PETG for zero material loss.

“Artisanally produced. Artisanally conceived.”

Paola Vilas, innovative aesthetics and sculptures.

Associate Paola Vilas represents modernist references and feminine forms in the creation of wearable sculptures.

“I chose jewelry as a way to express my view on contemporary issues such as feminism, but always from a provocative and sculptural aesthetic perspective,” Paola Vilas.

And last year, Paola Vilas promoted the unfolding of the brand’s conceptual universe and visual language in the new Home line: “sculptural pieces that celebrate the feminine and act as portals to a world where there are no limits between imagination and matter.”

“Bringing furniture to life, subverting the way we perceive our surroundings. Taking us out of the monotony of daily experience, subverting the way we perceive our surroundings and transporting us to a universe where anything is possible.”

Mariah Rovery, vitrification and reuse of metals.

Mariah Rovery, a pioneer in flower and fruit vitrification, promotes the blending of rough stones and jewelry classics in 100% reused gold.

“We are very concerned about the environment, and we are aware of the effects of our presence in nature. To reduce this impact, we took the initiative to exchange metals with the help of our customers and admirers.”

Creativity, Self-Expression, Colors, and Fun.

The brand presents Flex, expressing personality, ideas and essence through malleable, 100% recyclable, handcrafted, national and carbon friendly accessories.

“Objects of authorial expression.”

#posicionamentodevalor #valor #preço #posicionamento #tendências #insight #precificação #competitividade